A key objective of the Switzer Dividend Growth Fund is to provide a growing stream of income, maximising franking where possible, and long-term capital growth by investing in a portfolio of blue-chip Australian shares.

As such, we look for stocks with stable cash flows and a history of consistent dividend growth.

In this mid-monthly update, I would like to present a stock we hold in the SWTZ portfolio that reflects this investment philosophy, APA Group.

Stock in focus: APA Group (ASX:APA)

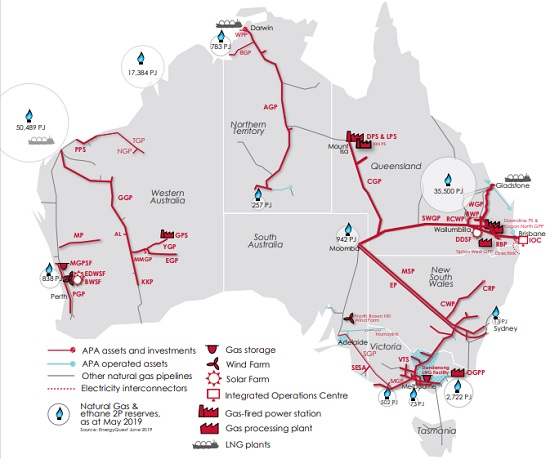

APA Group (APA) owns and operates Australia’s largest natural gas infrastructure business and other energy infrastructure assets such as gas storage and wind farms. It’s portfolio of assets under ownership and/or operation is over $21 billion.

APA’s 15,000 kilometres of natural gas pipelines connect sources of supply with markets across mainland Australia. The network connects natural gas to 1.4 million Australian homes and businesses, which is around half the nation’s natural gas usage.

Source: APA company presentation

Low risk business model

APA has a very low risk business model, in our view. Revenue streams are very stable and predictable due to a weighted average contract tenor in excess of 12-years (i.e. the weighted average amount of time APA’s clients are contracted to continue using their services). The assets are strategic given the growing importance of gas. With renewables (wind and solar) becoming a larger part of the Australian energy mix, gas is used as a firming fuel when output form renewables is low.

Recently we meet APA’s new CEO, Rob Wheals. Rob is an 11-year veteran of APA and has been heavily involved in the operation and growth of the company. We are confident that the APA strategy of considered, conservative growth remains on track under his leadership.

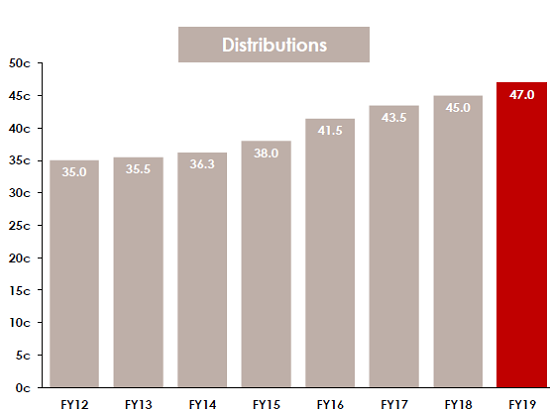

Distributions/ Dividend

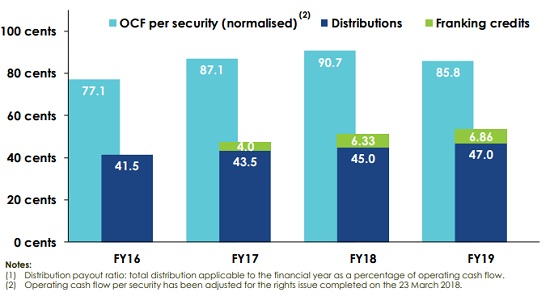

As shown in the charts below, the dividend compound annual growth rate (CAGR) has been around mid-single digits for the past 7-years. This has historically been well covered by the company’s cash flow. Company guidance for the 2020 distribution is 50 cents per security, which is an increase of 6.4%. This is expected to be covered by cashflow.

Source: APA Company Presentation

Source: APA Company Presentation

Summary

We believe APA offers exposure to an attractive, unique asset class with very high barriers to entry and limited substitutes. It has demonstrated resilient growth in revenues and earnings.

Stable cash flows, growing distributions and solid balance sheet make APA a great candidate for the SWTZ portfolio.

[sc name="post-disclaimer-swtz"]