Given the current market madness, I wanted to send a note to all of our SWTZ investors to explain my view on what’s happening right now, and whether or not you should panic.

In times like these, you need to take inspiration from wise words that have been framed out of history. With global markets down over 20% over the past few weeks I’m sure a lot of you would be asking: is it time to panic? And this is when I think of Tom Hanks — a recent coronavirus victim while here in Australia — and recount a great line in the movie Bridge of Spies.

In the movie, Hanks plays a US lawyer involved a prisoner swap with the Russians.

To one of the prisoners going back to Mother Russia, Hanks asked if he was worried that he might be seen as a traitor rather than a hero. And the prisoner came back with a great reply: “Would it help?”

Panicking about your losses in the stock market is understandable, but it doesn’t help. What we are seeing is the craziest crashes of the market — and I’ve seen a few.

The dotcom crash, especially in the US, was a sensible one. The GFC was an understandable one and so was the 1987 crash. But this one, based on uncertainty around the potential reduction of one quarter of economic growth and at tops two, is madness.

Uncertainty is a killer on a stock market.

As an investor in stocks, your capital has copped a whack over the past few weeks. The only historical argument that will help you through this worrying time is that stock markets do rebound out of these scary times.

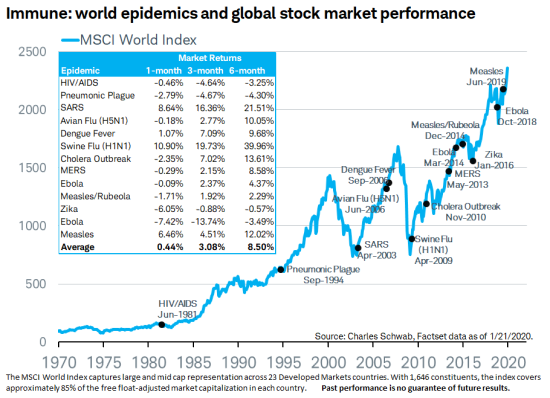

It’s worthwhile showing you the below chart of previous major outbreaks from SARS to Ebola, MERS, and so on. What the chart shows is that the stock market inevitably bounces back.

Source: www.marketwatch.com

The black dots on the chart show various epidemics the world has gone through and the market reaction. As you can see, rebounds happen. However, the chart does not show the anguish and anxiety of those who are exposed to stocks. And with term deposits so terribly low nowadays, who hasn’t got an exposure to stocks?

Of course, in actual terms, provided you’re not a seller of stocks, your losses are only on paper. Provided you’re in good quality companies (which you are via your investment in SWTZ), your dividends should keep coming and the share prices should come back to higher than current levels. You only cop the loss if you have to sell, so if you don’t have to, I’d suggest you just play the waiting game.

The great words of Rudyard Kipling and his famous poem “If” are entirely appropriate right now:

“If you can keep your head when all about you

Are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too…

…you’ll be a man my son!”

This is the time to keep your head, which should be easy to do given you’re invested in good quality companies via SWTZ.

During early 2009, I often spoke with Phil Ruthven from IBISworld, one of the world’s best researchers of industries and business. I asked him about what history says about the rebound of the Aussie stock market after a crash. Phil said our market rebounds between 30% and 80% in one year. Now that should help you deal with your panic.

Many people couldn’t take the pain of the sell-off in the GFC and went to cash and wacked it in a term deposit at 6%, and then saw our market rebound 36% between March and December that year.

This is like being in a hurricane or bushfire where you simply have to batten down the hatches. No one knows the real economic effects of the Coronavirus. And its guesswork that’s driving the stock market lower right now.

No one knows what the outcome of all this will be and how long it could last, but those who do the numbers on stocks are doing their best guesses and they’re erring on the side of caution with a capital C!

The US stimulus package, which was unwisely delayed by President Trump initially, should be helpful. The Australian Government’s response was a good start, but more might have to be promised through a second round of stimulus and in the Budget. And the Treasurer last week virtually told me that if more is needed, it will be found.

Don’t panic. A rebound will eventually kick in.

[sc name="post-disclaimer-swtz"]