Investment Objective

The Switzer Dividend Growth Fund (SWTZ) is an income-focused exchange traded managed fund with a mix of yield and quality companies. The objective of the fund is to generate an above-market yield while maximising franking where possible and to deliver capital growth over the long term. We select companies that, in aggregate, generate sustainable dividend income. The fund is characterised by a strong and diverse portfolio of companies that exhibit good cash flows and strong business models.

Performance Summary

Over the past 12 months, SWTZ has paid a distribution yield of 5.92%, or 8.46% including franking credits. Distribution yield is calculated as the distributions received over the 12 months to 30 April 2020 relative to the price at the beginning of the period.

Given its focus on income and capital preservation, over the long term we expect SWTZ to marginally underperform in rising markets and marginally outperform in falling markets. The portfolio was 7.82% higher over the month of April underperforming the S&P/ASX 200 Accumulation Index which returned 8.78%.

Portfolio Commentary

The Fund followed world markets higher over April. The recent bounce in the market presented an opportunity to finesse positions in the portfolio to improve the quality of the stocks held.

Small positions in Link Administration Holdings, Reliance Worldwide Corporation and Challenger were exited and a new position in REA Group was established. Positions were increased in companies we believe will see significant recoveries over the next year including Aristocrat Leisure, Atlas Arteria and Tabcorp Holdings.

There has been significant uncertainty over the size and timing of bank dividends. Banks make up a significant proportion of franked income in Australia and this uncertainty has impacted bank share prices. Over the month the Australian Prudential Regulation Authority directed banks and insurers to be conservative in dividend payouts over the immediate period. With unemployment rising there is continued uncertainty around how high bad debts will climb in this cycle.

Holdings in the banks were reduced in the SWTZ portfolio last year to index weights. Those weights were recently adjusted to take into consideration the likelihood of much lower or deferred dividends. The Fund did participate quite strongly in the National Australia Bank (NAB) raising, adding back shares that were sold previously at much higher levels.

Over the month all sectors in the ASX200 finished higher. Leading the rise was Energy (25.0%), Information Technology (22.5%) and Consumer Discretionary (15.9%) – all evidence of the better market conditions in April. The laggards were generally those sectors that performed better during the recent sell off. These included Health Care (0.8%), Consumer Staples (2.4%), Utilities (2.7%) and Financials (2.9%).

There were six stocks that delivered over 20% returns for the portfolio over April. These were: the Fund’s energy exposures Woodside Petroleum (27.3%) and Origin Energy (26.9%); stocks impacted by the lockdowns Star Entertainment Group (40.9%) and Tabcorp Holdings (27.3%); SWTZ’s gold exposure Evolution Mining (33.8%); and Challenger (24%) which was exited on this strength.

NAB was the only company to hold a capital raise within the SWTZ portfolio. We believe this is a sign of the strength and quality of the companies SWTZ holds. The Fund actively participated in raisings by companies not previously held. All these opportunities have been profitable thus far, with shares trading well above purchase prices.

Source: SMH

Market Commentary

Global equity markets have rallied over the past six weeks after a significant market selloff. All major markets were higher over April, led by the US. The Australian market was around the middle of the pack with a gain of 9.5%.

Bond markets were unusually stable over the month – a welcome relief after the volatility experienced in March. The high-yield bond markets also improved giving a solid backdrop for equity markets.

The market remains focused on the flattening of the growth rate of COVID-19 infections in various countries. Thankfully it appears the predicted worst-case scenarios will not eventuate. The response from Governments and Central Banks around the world is the largest coordinated stimulus effort since WW2. Markets have been encouraged by the fact that many of the fiscal packages are aimed directly at labour retention and immediate spending support to counter the lockdowns around the world.

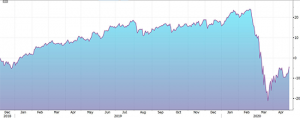

ASX200

December 2018 to April 2020

Source: Bloomberg

Portfolio Outlook

Over the last month, progress in containing the virus around the world has exceeded expectations. Credit markets have responded well with yields falling for loans to riskier companies. Over the next quarter we will likely see some of the worst economic data in living memory. Headlines will show growth collapsing and unemployment rising. The poor data is now widely expected by the markets, so it will be interesting to see the reaction when it is actually delivered.

The Fund has a diversified exposure to what we believe are the strongest companies in Australia. On a longer-term outlook, assuming a return to ‘normal’ economic activity, the market represents reasonable value to us. We expect capital appreciation from these levels into the medium term.

The outlook for dividends this year, however, will be under pressure as companies look to conserve cash. Investors should prepare for a period of lower yields. Sectors which traditionally deliver high yields, such as banks and REITs, have been severely impacted by the lockdowns while those sectors least impacted, such as health and technology, are low yielding. Predicting the extent of dividend reductions with any accuracy is difficult so SWTZ is focusing on holding, and adding where appropriate, to those companies that we believe can pay dividends over the course of this calendar year.

[sc name="post-disclaimer-swtz"]