A key objective of the Switzer Dividend Growth Fund (ASX:SWTZ) is to provide a growing stream of income, maximising franking where possible, and long-term capital growth by investing in a portfolio of blue-chip Australian shares.

As such, we look for stocks with defensive earnings and solid cashflows.

In this mid-monthly update, I would like to present a company we hold in the SWTZ portfolio that reflects this investment philosophy, Coles Group (ASX:COL).

Stock in Focus: Coles Group

The COVID-19 crisis has caused countless businesses to close their doors – but among the carnage a handful of sectors have thrived. Perhaps the most obvious winners are grocery companies.

Coles Group including fresh food, groceries, household goods and liquor via its network of stores and online platforms. It is Australia’s second largest retailer (behind Woolworths).

Each week Coles Group processes an average of 21 million transactions, and operates 2,500 retail outlets across the country.

Background

The Coles Group covers over 2,500 retail outlets nationally including Coles Supermarkets, Liquorland, Vintage Cellars and Spirit Hotels. In March 2018, Wesfarmers announced its proposal to demerge Coles, and Coles Group was re-listed on the ASX in November of that year. Steven Cain, the current CEO, has over 20 years of Australian and international retail experience including as CEO of supermarkets and convenience at Metcash Limited.

Recent Changes and Future Earning Drivers

Post demerger, the new management team implemented several significant changes across the Group to strengthen the business, reduce risks and improve earnings stability.

Partnership with Viva Energy (ASX:VVR)

Coles Group restructured its partnership with fuel business Viva Energy in February 2019. The revised agreement between the two companies enabled Viva Energy to assume full responsibility for the provision of fuel offerings, with Coles Group being able to take a commission of the sales. This alliance removed COL’s direct exposure to retail fuel price movements.

Incorporation with Australia Venue Co (ASX:AVC)

In early March 2019, Coles entered an incorporated joint venture with Australia Venue Co (ASX:AVC), a highly experienced operator of hospitality assets, with a portfolio of more than 60 venues across Australia.

This arrangement transferred Coles’ Queensland hotel business operations – a portfolio of 87 Spirit Hotels – to AVC, which then allowed Coles to focus on its 243 liquor store operations in the state. Coles Group currently owns 900 liquor stores across Australia.

Exclusive Partnership with Ocado

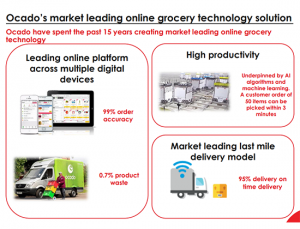

Also in March 2019, Coles entered into an exclusive partnership with Ocado with the aim to become the leading online grocery provider in Australia. Ocado is a UK based company and is listed in the London Stock Exchange. The business has more than 15 years’ experience in disrupting the traditional grocery market.

Under the agreement, Coles will launch a new website integrated with the Ocado Smart Platform and build two state-of-the-art automated centres in Melbourne and Sydney. The centres will each have over 1,000 robots, and will be able to handle between $500 million and $750 million worth of products a year.

Source: The Coles and Ocado partnership presentation

This strategic partnership will provide a better online customer experience with easier access to fresh Australian produce and a consistent product offering. In addition, it will improve supply chain efficiency with the current eight manual operations requirements being reduced to just two.

We believe this increase of sales capacity and a lower cost-to-serve could see margins increase. Online groceries are the next big challenge for Aussie supermarket providers, and Coles is well positioned for this.

Financials

Coles Group generates very defensive earnings and solid cashflow.

The company recently announced its H1 financial results for FY2020. Group revenue was up 3.3% to $18.8 billion (excluding fuel sales and hotels) and cash realisation was 87% for the half. Coles continues to target >100% cash realisation for the full year. Additionally, Coles reduced its net debt and currently has a very low ratio of net debt to EBITDA of 0.6x.

Due to the Group only being listed for a short period of time, there is little dividend history available. For H1 FY2020, COL has declared a fully franked interim dividend of 30 cents per share. Over the next half, the investment team predicts the dividend yield will be around 4-5%, based on the current share price.

Summary

The supermarket and grocery market in Australia is a very concentrated industry. Coles and Woolworths together account for nearly 60% of the national market share. Coles Group and its partnerships have provided the business with a strong and dynamic market position, enabling COL to generate stable long-term earnings with what we view as very low risks, especially during the current market volatility and sudden economic downturn.

Post the H1 financial results the investment team met the new CEO, Steven Cain, and new CFO, Leah Weckert. The SWTZ team believe the investment Coles Group has undertaken in data analytics, supply chain and other capabilities will drive better customer experiences, margins and sustainable earnings in the future. With increased earnings, distributions will also improve, providing a sustainable source of income to investors.

[sc name="post-disclaimer-swtz"]