We are pleased to provide you with a summary report on the performance of the WCM Quality Global Growth Equity Strategy (the Strategy) in February 2023.

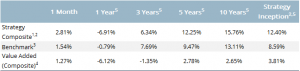

The Strategy1 delivered a return of 2.81% during the month, outperforming the benchmark MSCI All Country World Index return of 1.54%. The Strategy has delivered returns in excess of the benchmark MSCI All Country World Index over one month, five and 10 years, and since inception.

Notes: 1. WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have the same Portfolio Managers and investment team, the same investment principles, philosophy, strategy and execution of approach as those used for the WCM Quality Global Growth Strategy however, it should be noted that due to certain factors including, but not limited to, differences in cash flows, management and performance fees, expenses, performance calculation methods, and portfolio sizes and composition, there may be variances between the investment returns demonstrated by each of these portfolios and the WCM Quality Global Growth Strategy Composite (the Composite) in the future. As WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have only been in operation for a relatively short period of time, this table makes reference to the Composite to provide a better understanding of how the team has managed this strategy over a longer period. Performance is net of fees and includes the reinvestment of dividends and income. 2. Composite inception date is 31 March 2008. 3. Benchmark refers to the MSCI All Country World Index (with gross dividends reinvested reported in Australian Dollars and unhedged). 4. Value Added equals Composite Performance minus Benchmark performance. 5. Annualised.

The Strategy is conveniently available via four investment structures to accommodate the differing preferences of individual investors. You can find the monthly investment update under ‘More Information’ for each of these products on the links below:

- WCM Global Growth Limited (ASX:WQG)

- WCM Quality Global Growth Fund (Quoted Managed Fund) (ASX:WCMQ)

- WCM Quality Global Growth Fund (Managed Fund) (Unhedged)

- WCM Quality Global Growth Fund (Managed Fund) (Hedged)

Strategy Update

While global equity markets actually retreated over the month, the Australian dollar was significantly weaker against the US Dollar in February, which resulted in enhanced returns for unhedged global equity portfolios. In general, signs of more resilient economic growth promoted a shift in market sentiment regarding the likely peak and then reversal of global interest rates. These signs included stronger than expected US labour market data, European business surveys showing heightened confidence and evidence of a sharp post COVID-19 lockdown rebound in China. The US Federal Reserve, Bank of England and European Central Bank all increased interest rates in February. The commentary from each suggested that while inflation has declined from the peak, central banks believe their job is not done yet. In terms of individual markets, Europe fared best with each of the major continental bourses posting flat-to-positive returns. Emerging markets were the major laggard with narrow performance dispersion at a sector level. Information Technology and Industrials were among the better performing sectors. Quality and growth factors marginally outperformed value.

The portfolio’s outperformance in February can be largely attributed to stock selection. This was particularly evident in the strategy’s holdings in the Consumer Discretionary, Materials and Financial sectors. Security selection in the Information Technology sector was the largest drag on relative performance. From a sector allocation perspective, the zero exposure to Communication Services was the largest positive contributor followed by the overweight positions in Information Technology and Industrials. On the flipside, the above benchmark allocations to Health Care and Consumer Discretionary and underweight position in Consumer Staples detracted from performance.

February was another month in which the market seemed to flip from the hope of a potential ‘pivot’ in the direction of global interest rates to one of fear over ‘higher for longer’. With central banks showing a preference to err on the side of potentially over-tightening monetary policy to ensure inflation is beaten, rather than move too slowly and risk it becoming entrenched, an economic slowdown and/or a recession seems likely. This would inevitably put pressure on global corporate earnings. The WCM Quality Global strategy is not constructed based on any macroeconomic forecasts or expectations. However, its exposure to a diversified range of expanding moat companies with aligned corporate cultures should prove relatively robust in a market where investors are putting a premium on earnings certainty.

DISCLAIMER: AGP Investment Management Limited (AGP IM) (ABN 26 123 611 978, AFSL 312247) is a wholly owned subsidiary of Associate Global Partners Limited (AGP) (ABN 56 080 277 998), a financial institution listed on the ASX (APL). AGP IM has prepared this material for general information purposes only for WCM Global Growth Limited, a listed investment company (ASX: WQG).

AGP IM is the responsible entity for WCM Quality Global Growth Fund (Quoted Managed Fund) (ARSN 625 955 240) (ASX: WCMQ) and WCM Quality Global Growth Fund (Managed Fund) (ARSN 630 062 047).

AGP International Management Pty Ltd (AIML) (ABN 33 617 319 123) is the investment manager for WQG and is an authorised representative of AGP IM. WCM Investment Management, LLC (WCM) is the underlying manager and applies its WCM Quality Global Growth Equity Strategy (the Strategy), excluding Australia, in managing each of WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund)(the Funds). WCM does not hold an AFSL. WQG and CIML are part of the AGP Group.

Any references to ‘We’, ‘Our’, ‘Us’, or the ‘Team’ used in the context of the portfolio commentary, is in reference to WCM Investment Management, as investment manager for the Strategy or CIML as investment manager for WQG.

Even though the Strategy, excluding Australia, is applied to each of WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) certain factors including, but not limited to, differences in cash flows, fees, expenses, performance calculation methods, portfolio sizes and composition may result in variances between the investment returns for each portfolio. The performance of the Strategy is not the performance of the portfolios and is not an indication of how WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) would have performed in the past or will perform in the future.

The material should not be viewed as a solicitation or offer of advice or services by WCM, AGP or AGP IM. It does not contain investment recommendations nor provide investment advice. It does not take into account the objectives, financial situation or needs of any particular individual. Investors should, before acting on this material, consider the appropriateness of the material.

Neither AGP IM, AGP, their related bodies corporate, entities, directors or officers guarantees the performance of, or the timing or amount of repayment of capital or income invested in the Funds or that the Funds will achieve its investment objectives. Past performance is not indicative of future performance.

Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided that the positions will remain within the portfolio of the funds. Any securities identified and described are for illustrative purposes only and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Investors should seek professional investment, financial or other advice to assist the investor determine the individual tolerance to risk and needs to attain a particular return on investment. In no way should the investor rely on information contained in this material.

Investors should read the Product Disclosure Statements (PDS) of the Funds or any relevant offer document in full before making a decision to invest in these products.