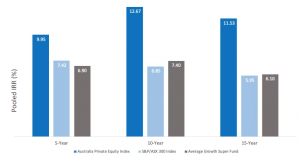

When the Australian Investment Council, the peak investment body for private asset managers, released the performance highlights for the most recent financial year it was shown yet again that Australian Private Equity outperformed listed markets over a 5, 10 and 20 year period by between 2.0% and 8.9% p.a. net of all fees:

Sources: Cambridge Associates, Chant West, AIC. Returns as of 30 September 2020. Super funds data is for the average Australian super fund under the Growth option only. All returns are net of investment fees and tax. The Australian PE Index tracks all PE funds domiciled in Australia, formed between 1997 and 2019.

These results are consistent with findings overseas and makes intuitive sense given investors should be rewarded with an “illiquidity premium” for investing in private assets.

But what is less understood is what drives these consistently superior returns. We set out in this paper to examine some of the key factors that contribute to Private Equity’s outperformance.

Greater Opportunity Set

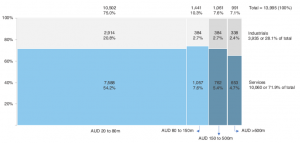

Illion, in a recent report on SME business opportunities estimated that there are around 14,000 private companies in Australia which could be classed as small-medium (revenues of $20-150m). This contrasts with the number of larger private businesses (~2,000) and the typical public fund universe of 200-300 securities. It can even be argued that the real investable universe for public equity large-cap managers is even smaller as many managers are restricted to primarily dealing in the top 30-50 securities given their mandate and liquidity constraints.

But how accessible are these private companies to PE managers? In a report published in 2017 by PricewaterhouseCoopers, over two-thirds of founders or family business owners indicated they will sell their business or pass it on to the next generation in the next five years providing ample acquisition opportunities for private equity managers.

The existence of a greater number of companies being competed for by a fewer number of purchasers leads to more opportunity to find “undiscovered gems” at prices that don’t necessarily find equilibrium through normal market discovery processes.

Number of Australian private companies by sector activity and by size of revenues:

Source: Illion

Services: Trade, Accommodation and Food Services, Transport, Postal and Warehousing, Information Media and Telecommunications, Financial and Insurance Services, Professional, Scientific and Technical Services, Administrative and Support Services, Public Administration and Safety, Education and Training, Health Care and Social Assistance, Arts and Recreation Services and Other Services.Industrials: Mining, Manufacturing, Electricity, Gas, Water and Waste Services and Construction.

Lower Entry Multiples

The entry multiples, that is the measure of the price paid for a business as a multiple of EBITDA, are lower for private businesses than they are for public ones. This is a natural outcome from greater public company information availability combined with the fact that the price that purchasers are willing to pay being lower for private assets.

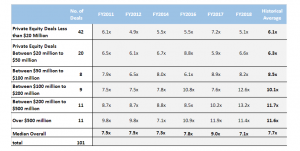

In turn, multiples paid for small to medium private businesses are on average lower than those paid for larger businesses due to those businesses being perceived as being more risky. The table below shows that multiples for small-mid-sized private businesses in Australia generally fall between 6-8x EBITDA whereas larger businesses fall into the 10-12x range.

The price that a purchaser pays for an investee company is critical in determining the return an investor achieves.

Multiples of completed Australian company transactions grouped by Enterprise Value

Source: Dealtracker2020; Grant Thornton

Value Created Through Intervention

With larger listed businesses it is often the case that they are able to afford to employ the expertise to enable operations and strategy excellence to create efficiencies that enhance overall company performance. This is rarely the case with private businesses and particularly with smaller businesses which are family or founder-owned.

For small, family-owned companies and start-ups with less management capability, significant value can be created by leveraging the expertise provided by private equity firms. Company efficiencies are improved, growth is accelerated through customer expansion, M&A activity initiated, managing cash, reducing costs, attracting talent and improving IT systems.

Often these businesses see private equity as a valuable way of accessing industry experts who can assist with benchmarking, accessing new markets and generally providing expertise that is not easily accessible otherwise.

Adams Street Partners quantified the sources from value creation in the US LBO Private Equity market from revenue growth being at 38% and multiple arbitrage (which is often a by-product of revenue growth) at 33% meaning the managers they studied brought meaningful value to private investments primarily through the enhancements they made to private businesses.

Less Red Tape

It can be argued that the focus of boards on corporate governance related to shareholder requirements and oversight can stifle entrepreneurial spirit. Listed company boards spend large amounts of time concerned with control-related topics and shareholder reporting as opposed to matters concerning expanding the business. Private equity managers are often able to strike a balance between governance and growth to deliver on their investment thesis and increase the value of their portfolio companies.

There are a multitude of other reasons that private equity may result in better company performance that public ownership. These include:

- Release of capital constraints: An injection of capital under private ownership may enable improvements and/or financing of growth opportunities that may have been limited where capital sourcing opportunities were inhibited through public ownership restrictions

- Patient capital: Private equity managers can choose when to deploy capital based on opportunities available, economic conditions and price. The evidence that timing when to invest can make meaningful differences to performance outcomes is evidenced by the fact that Private Equity funds that invested during and following significant economic downturns have significantly outperformed other vintage years.

- Lack of analyst coverage: For some smaller listed businesses, their lack of size means less company analyst coverage which can inhibit a companies ability to raise capital for growth opportunities. This issue goes away with private ownership focussed on investing for growth.

In conclusion: Private Equity has been shown to outperform public equity over long periods across numerous markets, for a number of reasons. Institutional investors have known this for decades and have allocated meaningful amounts to the asset class. Through Vantage Private Equity individual investors now have the opportunity to participate in these institutional, private opportunities and access the significant returns that the Private Equity asset class delivers.

Source: Vantage Asset Management